Digital securities are a key component of the new financial infrastructure that is emerging in the European Union. While the market may seem boring compared to the booms and busts of the crypto world, the wave of digital securities is as inexorable as Bitcoin's was not that long ago. Bitcoin was a bottom-up movement. Regular people kept trading it and a handful of brilliant people kept researching the fact that it enabled the introduction of scarcity in the digital world (you can copy any digital file with a click, but if the original is registered on a blockchain, no copy can substitute it).

Digital securities, on the other hand, are a top down wave. In addition to a growing number of national regulators, some of the supranational institutions promoting its implementation include the European Union, the European Investment Bank, the OECD, The World Economic Forum, or the International Organization of Securities Commissions. On the private side, all of the most prominent banks in the world have launched their own blockchains, blockchain divisons, blockchain services and so on, while tokenization platforms like Token City are garnering more and more interest.

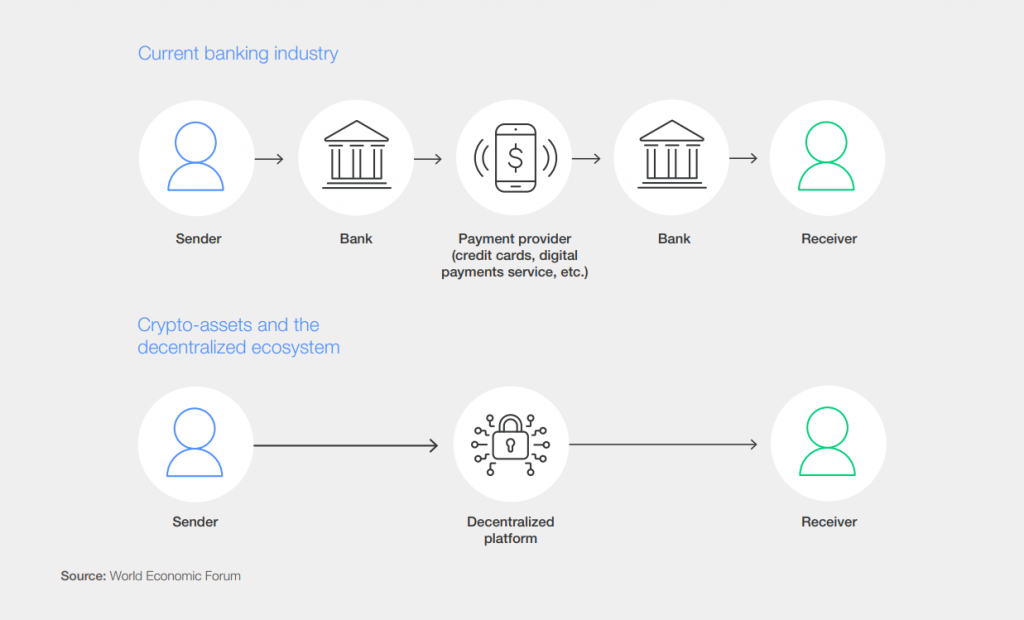

The following illustration highlights why this is the case: By disintermediating processes, blockchain opens the door to instant, secure, borderless and cost effective transactions, not only of cash but also tokenized securities.

Regulatory pathfinding

It's the regulatory aspect of blockchain implementation what determines the rate of adoption within the wider financial system. In a recent report by the World Economic Forum coauthored by the Global Blockchain Business Council, five different approaches to crypto asset regulatory development are described:

Agile crypto regulation

The regulatory approach applied by the EU with the Pilot Regime falls in this category. It is flexible, responsive, and designed to evolve with the sector in a process that allows iteration. The idea behind agile regulation is that traditional regulatory methods might be too rigid to keep pace with rapidly changing industries, particularly in the tech sector. This can lead to outdated rules that don't effectively protect consumers or promote competition, or conversely, to a lack of rules where they're needed.

Agile regulation relies on regulatory sandboxes and guidance to let companies test new types of solutions. The concept is inspired by agile principles that originated in the software development industry, where they're used to prioritize adaptability and customer collaboration. The Pilot Regime enables companies to legally trade asset-backed crypto tokens on blockchain-based exchanges for a period of years and under certain limitations, in order to define the final regulatory framework for security tokens (asset-backed tokens).

Principle-based crypto regulation

Principle-based regulation is a type of regulatory approach that uses broad, overarching rules or principles to guide business conduct, rather than detailed, prescriptive rules. The idea is to set out the fundamental obligations and expectations for businesses, allowing them some flexibility in how they meet those standards. The UK is a good example of this regulatory approach to crypto regulation, which is explicitly guided by the “same risk, same regulatory outcome” principle.

Risk-based crypto regulation

In a risk-based regulatory approach the frequency and intensity of monitoring and enforcement activities are proportionate to the level of risk associated with a business or sector's operations. This approach allows regulatory bodies to use their resources more efficiently by focusing on high-risk areas that may pose greater potential harm to public interests. The Monetary Authority of Singapore stands out as an example of this regulatory approach.

In the realm of crypto assets, the predominant focus on financial applications has led both global bodies and national regulators to endorse a risk-centric regulatory approach to maintain equality and balance, although it's critical to differentiate between centralized and decentralized entities. The majority of Decentralized Finance (DeFi) applications do not hold or directly control customer funds, so the risks involved are very different from those in traditional finance even if the functions performed are similar. At the same time, when applying a risk-based strategy, risk mitigation achieved through the already existing financial structure must be taken into account.

Self and co-regulation

Self-regulation allows an industry or group of entities to regulate itself, without direct involvement from government regulators. This might involve developing and enforcing its own codes of conduct, establishing its own standards, or setting up its own dispute resolution mechanisms. Since it tends to incorporate lighter requirements and not be effectively enforced due to lack of direct regulatory backing, co-regulation alleviates these issues. According to the report, this entalis a non-governmental organization formed by participants of a particular industry or sector "to assist in the regulation of enterprises in that area with the oversight of the regulator".

As an example, the Financial Services Agency (FSA) in Japan granted self-regulatory status to the nation's cryptocurrency industry, allowing the Japan Virtual Currency Exchange Association (JVCEA) to monitor and enforce rules on Japanese cryptocurrency exchanges, subject to supervision by the FSA.

Regulation by enforcement

Regulation by enforcement is a practice where regulatory bodies use enforcement actions, such as fines, penalties, and lawsuits, to establish or clarify regulatory standards. Instead of creating new rules or guidelines through the usual rule-making process, regulators use enforcement actions to signal their expectations and interpretations of existing laws. Currently, the United States is the most important jurisdiction applying this approach.

For its latest batch of enforcement actions, the SEC recently initiated legal action against two of the largest companies in the sector (Coinbase and Binance), while publishing a list of 19 tokens that it considers to be securities. This approach creates a deep sense of discouragement and uncertainty in industry players. The report by the World Economic Forum does not recommend crypto regulation by enforcement, as it creates a confrontational environment where no collaboration or constructive dialogue between the SEC and crypto companies can take place.

The challenges ahead

The global reach of the blockchain, the inherent interconnectivity within the crypto asset ecosystem, and the potential for connections with the conventional financial system underscore the need for a worldwide strategy in regulating crypto assets. At the same time, there's no perfect answer when figuring out how to best regulate something that’s borderless, open-source, decentralized and constantly evolving.

Several international organizations, including the Financial Stability Board (FSB), the Basel Committee on Banking Supervision (BCBS) and the International Organization of Securities Commissions (IOSCO) – are are spearheading regulatory efforts at the international level, although there's still a long way towards a harmonized global regulatory environment.

As a member of the Global Blockchain Business Council, coauthor of the WEF report, Token City closely watches global regulatory developments. Fragmented monitoring and legal categorization of crypto assets are the main barriers ahead, challenges that underscore the relevance of MiCA and the Pilot Regime, the crypto-friendly regulation approved by the EU on behalf of 27 countries and 450 million people, with a total estimated GDP of 16 trillion euros.

Entra en la nueva economia tokenizada

Token City es el puente definitivo hacia a la economía tokenizada (tEconomy), en la que las empresas tokenizadas (tEnterprises) crean sus mercados de cripto activos (tMarkets), abiertos a inversores globales (tCitizens).