Tokenization has the potential to revolutionize the distribution of alternative investments to individuals, as highlighted in the Bain & Company report How Tokenization Can Fuel a $400 Billion Opportunity in Distributing Alternative Investments to Individuals. By streamlining, automating, and simplifying the process, tokenization can overcome the challenges faced by individuals in accessing alternative investments.

Traditional alternative investments have been predominantly focused on institutional investors, leaving wealthy individuals underrepresented in this market to the point that, the bespoke and manual nature of alternative investing has become a longstanding barrier to entry for these individuals. Thanks to blockchain technology, tokenization can address these issues and unlock a $400 billion opportunity for the alternative investment industry.

How can alternative investment distribution be improved through tokenization?

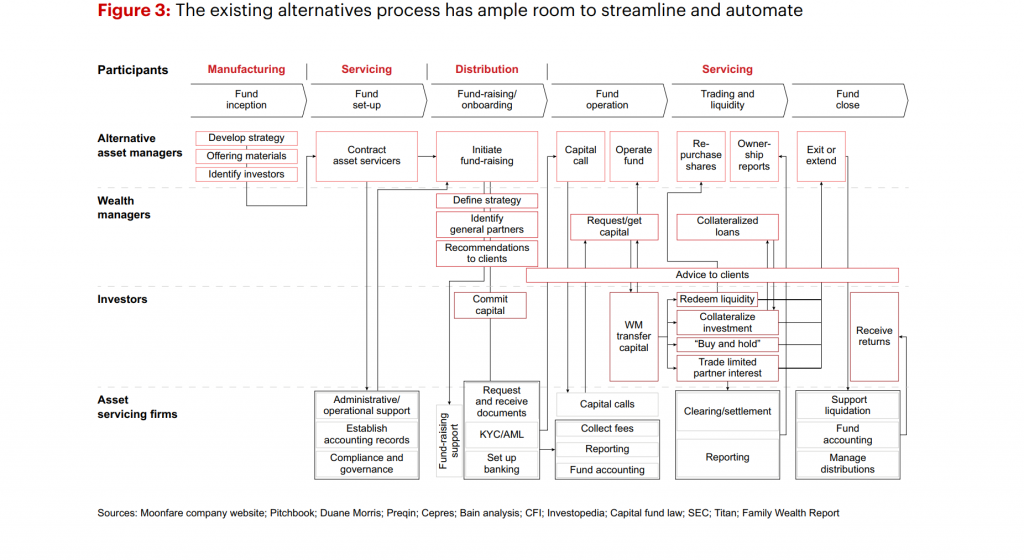

As shown in the graph below, the current alternative investment process is complex. Most of the elements comprise large amounts of administrative paperwork and additional fees.

Process simplification is arguably the main improvement that asset tokenization brings to the table. By eliminating the manual and bespoke nature of alternative investments, they become more accessible to individuals. Digitizing investments into tokens renders the process more efficient and standardized, which results in a faster, less expensive investment process.

Liquidity enhancement enabled by asset tokenization results in deeper liquidity, allowing individuals to buy, sell, and trade their investments more easily.

Collateralization and Risk Mitigation thanks to tokenization provides additional security for asset managers. Individuals can use tokenized assets as collateral for loans or other financial transactions, reducing risk.

Automation of Capital Calls (the act of transferring to an investment fund the amounts previously allocated by investors) simplifies the process. It eliminates manual coordination and paperwork, making the investment process more efficient for individuals.

Tokenized portfolio customization allows individuals to select and combine different tokenized assets based on their preferences, risk tolerance, and investment goals. This flexibility enables the creation of diversified portfolios tailored to individual needs.

Significant outcomes

The outcomes of these improvements are significant. By leveraging tokenization, the alternatives industry can unlock an additional $400 billion in annual revenue. Wealthy individuals gain access to higher-quality portfolios and a wider range of investment options. Alternative asset managers can expand their investor base beyond institutions. The supply and demand gap within alternative investments can be addressed, providing individuals with increased diversification and potential returns.

Half of the global wealth belongs to individuals but they allocate only about 5% of their net worth to alternatives. At the same time, Bain indicates that 53% of individual investors with $5 million or more in assets plan to increase their alternatives allocation.

In summary, tokenization offers a transformative opportunity to improve the distribution of alternative investments to individuals. By leveraging the benefits of digitization, the industry can unlock significant revenue potential, provide individuals with enhanced access and portfolio customization, and address the supply and demand gap within alternative investments.

Entra en la nueva economia tokenizada

Token City es el puente definitivo hacia a la economía tokenizada (tEconomy), en la que las empresas tokenizadas (tEnterprises) crean sus mercados de cripto activos (tMarkets), abiertos a inversores globales (tCitizens).