Just last month, in April 2023, the groundbreaking MiCA regulation was enacted on behalf of the 450 million inhabitants across the 27 European member states. We are witnessing MiCA's tangible influence even in such a short span of time, strongly suggesting that Europe is now primed to define the future of the token economy and the cryptocurrency landscape worldwide.

The effect of MiCA in the cryptocurrency sector

MiCA establishes definitions and guidelines for both issuers of crypto assets and crypto asset service providers (CASPs). In order to issue crypto assets, organizations have to provide comprehensive and clear information about the crypto assets they release, while also adhering to rules on disclosure and transparency. Additionally, CASPs need to be officially registered within the EU territory and must incorporate both security protocols and adherence to anti-money laundering regulations.

MiCA's focus is on stablecoins crypto exchange activity and crypto payment and custody operations. While the MiCA regulation leaves out DeFi, NFTs and cryptolending, which are yet to be regulated, it brings much needed clarity to the crypto European ecosystem, most notably, clear rules for companies operating in the space regarding investor protection and transparency.

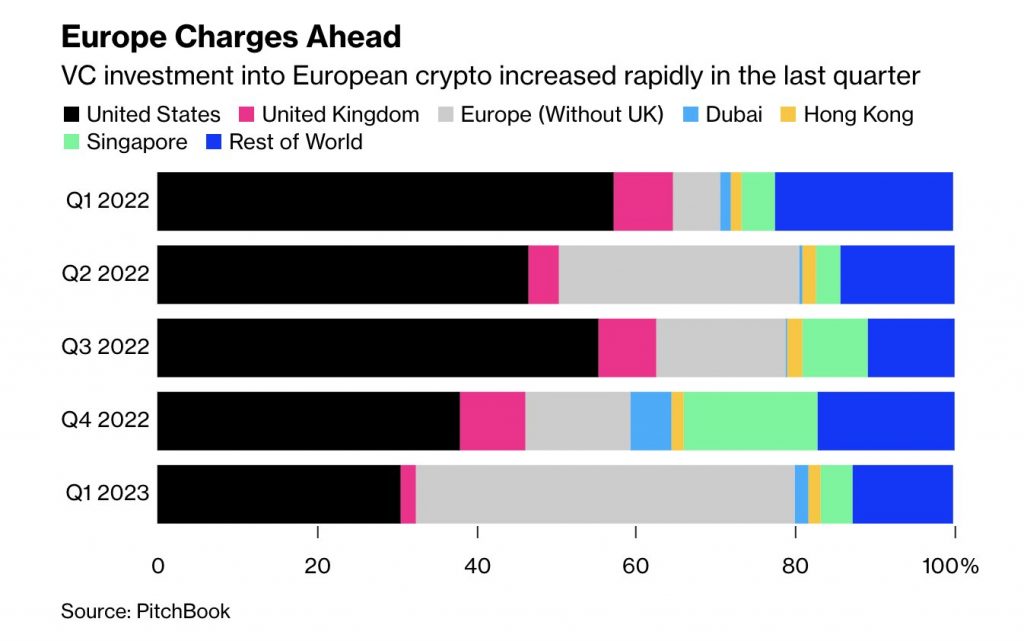

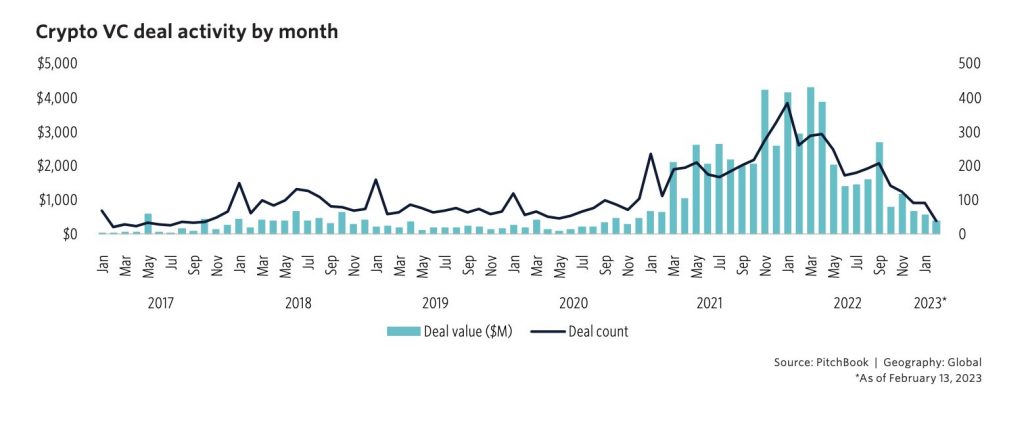

As a result, the impact of enhanced regulatory clarity is not just noticeable, it may be completely game-changing. According to the latest PitchBook data, the crypto landscape in Europe already seems to be experiencing a seismic shift. Venture capital funding channeled into European crypto ventures has skyrocketed, experiencing a staggering tenfold increase in just one year - catapulting from a modest 5.9% in Q1 2022 to an exceptional 47.6% in Q1 2023. As shown below, this monumental surge in Europe's share of crypto investments is unfolding despite dwindling investments worldwide.

Europe is now a haven for the crypto and security token industry

A study conducted by Cornerstone Research revealed that the SEC has to date initiated 75 legal actions against individuals and companies in the cryptocurrency sector, including entities linked to illicit activities, such as FTX and the company responsible for Terra. However, it has not stopped at clear cases of wrongdoing. Many other cryptocurrency projects have also been subject to enforcement action, with the "crime" often being ambiguity as to whether their cryptoasset can be considered a security.

Last March, Coinbase CEO Brian Armstrong revealed that the company had received a "legal threat" from the Securities and Exchange Commission regarding "an undefined portion" of the company's listed digital assets, as well as some of its services. Litigation against players in the industry seems to be a SEC strategy to use individual cases as a way to establish regulatory policy for crypto, rather than adhering to formal rulemaking processes or waiting for legislative clarity from Congress about when U.S. securities laws are applicable to digital assets.

In multiple cases the entity considered to have certainty that its assets did not meet the definition of security, only to receive a severe reality check from the SEC, asserting otherwise through legal action. In addition, the SEC tends to be able to impose itself on companies with fewer resources, without necessarily being able to do so with the most capitalized companies, which is worsening the sector's sense of unfairness.

Compared to such adversarial context, the EU is increasingly perceived as a crypto haven, with established companies like Binance, Coinbase or Circle deploying more resources within the UE and their leaders stating that clear guidelines, even if not perfect, are far preferable to no guidance at all. Brian Armstrong has publicly declared his willingness to relocate out of the US if the situation doesn't improve.

Besides MiCA, the Pilot Regime, focused on security token issuance and trading, has also entered into force in Europe, allowing companies to legally trade security tokens and provide security token trading services within certain limits and restrictions. the Pilot Regime is the first EU-wide financial regulatory sandbox, whose aim is to facilitate the gradual introduction of security tokens into the economy, without generating unexpected risks. With MiCA and the Pilot Regime, the EU is positioning itself as the main global jurisdiction for crypto asset companies.

Enter the new tokenized economy

Token City is the ultimate bridge to the tokenized economy (tEconomy), in which tokenized companies (tEnterprises) create their cryptoasset markets (tMarkets), open to global investors (tCitizens).